October 2024: Web3 Fundraising Snapshot

A cheeky peek at pre-seed to Series A projects

Comment from

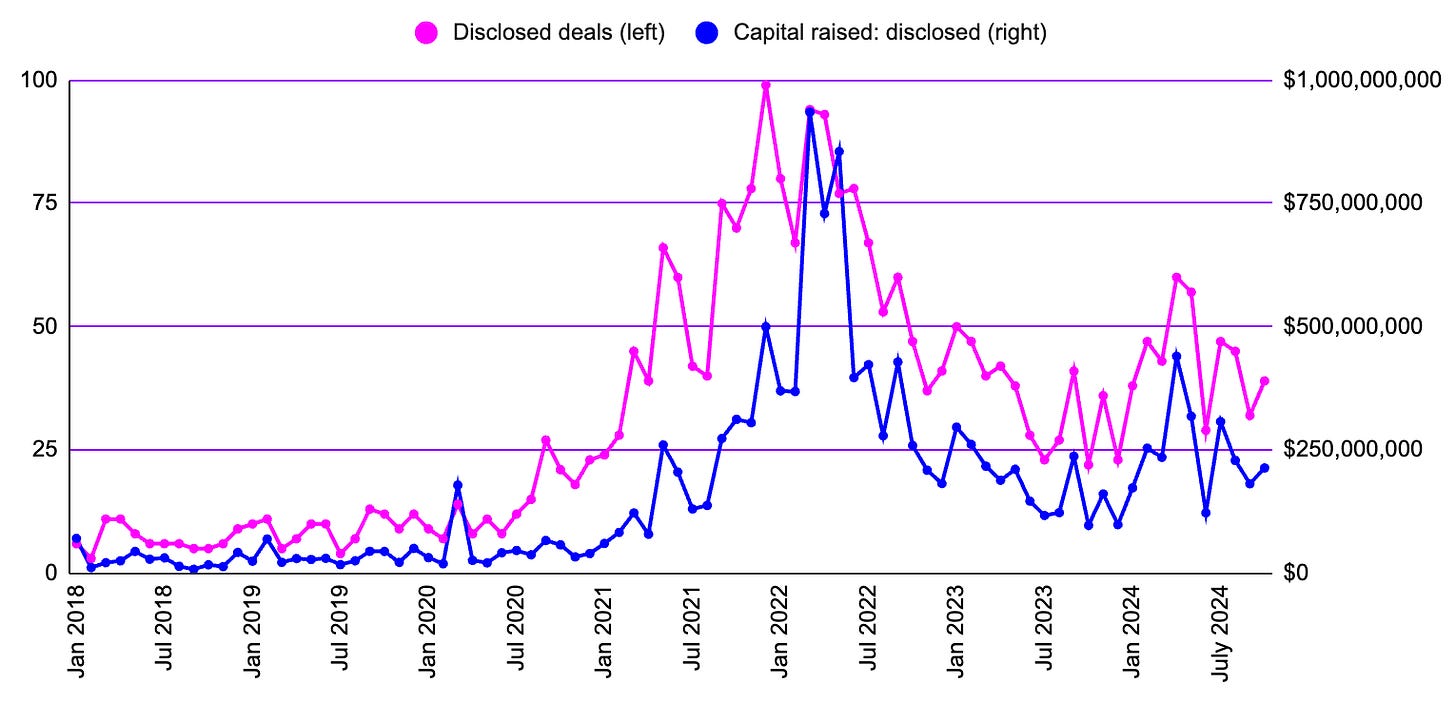

: October… I don’t remember it that well to be honest. November has been a hot month for sure with one BTC ATH OMG LFG 123 after the other. But October… A lot of memes. I think I became a little confused. I think the Web3 startup fundraising market was a little confused too. There were definite signs of improvement, but they should not be overstated. Furthermore, the monthly snapshot of the fundraising market represents more of a time capsule to the sentiments of investors in the previous months than of the zeitgeist in the moment. I’ve written about this before. Fundraising deals that were closed in October are ones which founders have been toiling to wrap up for months. There is a delay between how the wider crypto market is performing and the deployment of capital through venture funding. Given what we already know of November in the crypto market, should we expect a considerable increase in total deal count and volume of capital raised by startups in the following two months of this year? Typically, November and December are not periods of heightened deal activity anyway. This is a time of winding down operations and waiting to look upon the new year with fresher eyes. New deals are still considered. However, the time horizon for executing decisions on projects investors have discovered before the Christmas holidays spills over into the first quarter of the next year. The question is, will the bull run in the crypto markets compress this timeline for decision-making in the Web3 venture market? There is, of course, always the American question to consider. A new administration and a resignation of the loathed SEC gazzer (he who shall not be named) fresh off the press would suggest to me that investors might hold their breath until after the first month of 2025 is over to see which way the wind is truly blowing.Web3 market overview: Companies fundraising at all stages since 2018

October 2024 top line figures:

$2.3bn raised across 171 projects (disclosed), well over double the previous month ($870m in September 2024).

This represents a new monthly high for 2024. Previously, the highest amount of capital raised in one month this year was in August ($1.7bn).

Total deal count was 337, up 49% from September 2024. Based upon this, we can infer that an estimated $4.5bn was fundraised across all stages. The month with the highest deal count in 2024 is still April (279 deals disclosed, 393 deals in total).

$13.8bn across 1821 projects (disclosed) raised in 2024 so far.

Total deal count is 2873, estimated $17.2bn in capital raised in 2024 so far.

Market highlight of the month:

Praxis' $525M fundraise is significant for the web3 ecosystem because it represents a bold step toward integrating decentralised technologies with real-world applications at scale. By leveraging RWAs to finance a futuristic city in a Special Economic Zone, Praxis demonstrates the potential of crypto-native funding mechanisms to unlock regulatory, financial, and cultural barriers for innovation. The project aims to attract top talent and foster breakthroughs in AI, crypto, biotech, and more, showcasing web3's ability to drive real-world impact beyond digital assets. If successful, Praxis could inspire confidence in large-scale blockchain-enabled projects and set a precedent for web3-driven urban development.

Crypto venture capital fund launches since 2022

$90m raised across three fund launches:

GnosisDAO is launching a new $40 million venture fund targeting real-world assets, crypto infrastructure and payments.

VanEck Launches New $30 Million Venture Fund for Crypto and AI Startups

Gate Ventures, Movement Labs, Boon Ventures to launch $20M crypto fund, supporting protocols targeting the Move programming language and interoperability with the Ethereum ecosystem.

Pre-seed fundraises since 2018

$34.7m raised, -17% from the previous month, across 14 pre-seed stage fundraises (disclosed).

Total deal count was 18, up from 15 in September 2024: estimated $42m in capital raised across all deals.

Average around size for pre-seed stage this month: $2.5m.

Running average round size for pre-seed companies: $1.6m pre-seed fundraises since 2018.

Pre-seed highlight of the month:

Kiva AI's recent $7M pre-seed fundraise is significant for the Web3 ecosystem as it highlights the growing demand for high-quality, scalable, and cost-effective data solutions tailored for specialised AI applications. With backing from prominent Web3-focused investors like CoinFund and Hashkey, Kiva AI is well-positioned to enhance decentralised AI systems, which rely on robust data annotation and human-in-the-loop feedback for better performance. By expanding its global network of human experts and advancing its solutions, Kiva AI can address critical challenges in industries like finance and law, aligning with Web3's emphasis on transparency, reliability, and decentralisation to enable innovative, trust-based applications across these domains.

Seed fundraises since 2018

$214m raised, +18% from the previous month, across 39 seed stage companies (disclosed).

Total deal count was 43, up from 38 in September 2024; estimated $235m in capital raised across all deals.

Average around size for seed stage this month: $5.5m.

Running average round size for pre-seed companies: $4.6m.

Seed highlight of the month:

Ithaca’s $20M fundraise, led by Paradigm, is a significant milestone for the Web3 ecosystem as it empowers a team of seasoned developers to accelerate innovation across the crypto stack while sustaining open-source public goods. With proven expertise in delivering industry-defining tools like Reth and Foundry, Ithaca is well-positioned to address critical bottlenecks in Layer 2 scalability, user onboarding, and developer functionality. Their first initiative, Odyssey, introduces cutting-edge features and experimental EIPs ahead of Ethereum’s mainnet upgrades, enabling developers to build faster and smarter. By fostering collaboration with major L2s and infrastructure providers and pushing the boundaries of cryptographic and EVM innovation, Ithaca’s work lays the groundwork for the next generation of applications, driving mainstream adoption and unlocking new consumer experiences in crypto.

Series A fundraises since 2018

$147m raised across 10 Series A stage companies (disclosed).

Total deal count was 11: an estimated $163m in capital raised across all deals in this stage group.

Average around size for Series A stage this month: $15m.

Running average round size for Series A companies: $17.5m.

Market highlight of the month:

Azra Games' recent $42.7m Series A fundraise is significant for the Web3 ecosystem because it highlights the convergence of blockchain technology with mainstream gaming, emphasising how digital ownership and immersive economies can redefine player experiences. Led by prominent investors like Pantera Capital and a16z crypto, the funding validates the potential of integrating Web3 principles, such as decentralised economies and player empowerment, into highly scalable and engaging mobile RPGs. Azra's focus on leveraging AI for scalable content creation and developing "4th generation" RPGs (on par with PC and console experiences) signals a paradigm shift in mobile gaming, positioning blockchain-enabled games as a competitive force in the broader gaming industry, potentially accelerating the adoption of Web3 technologies among mainstream audiences.